although theoritically,top h&s patterns targets were around 3750,12600 for nifty and sensex,last weekend ,i had a glance on dow chart,and i noticed one thing on daily chart of dow that there too was a top h&s in progress, but the neckline wasnt broken,and i have learnt to use multiple period charts to arrive at combination,i found that ,even if the h&s was to complete on dow daily chart,it will take a while, simply because,on weekly charts stochastics was in oversold zone,,leaving a little space to breakdown IMMEDIATELY.

NOW, that gave me a ready clue that our markets will take supports at those levels given immediately post budget..they were 3930 and 13334.....this assumption was supported by a FAILURE OF SYSTEM SELL CALLS ON RALIANCE 15 MIN. CHARTS....My trading system is unique in one way...that is DOUBLING AT STOPLOSS ,the simple reason behind this is ,,that the combination of different technical tools in generating buy-sell calls is so powerfull and so effective that it gives result on atleast 82% of times..(RESULT OF MY BACKTEST ON 1 MINUTE NIFTY CHART OF LAST 1 YEAR),,NOW if such powerfull system is stopped out,i understand that the forces ON OTHERSIDE..is so powerfull that it can easily give THE LOST points by doubling at sl.

i have while analysing learnt to use three things

1) multi time frame charts..(daily,weekly,monthly etc )and for intraday (1,3,5,15 mins)..as a COMBINATION.

2) MULTIPLE TOOLS..like innovative use of fibonacci ratios,,candle patterns , my system etc.

3) using different signals from major pivotals like (ril,hdfc,rel cap,tata power)

this helped me a lot ..at supports 3930...my sytem was generating buy calls in some leading stocks on WEEKLY BASIS...,a hammer formed on daily charts on indices,,and sell call in THE ULTIMATE LEADER RELIANCE ,STOPPED OUT.

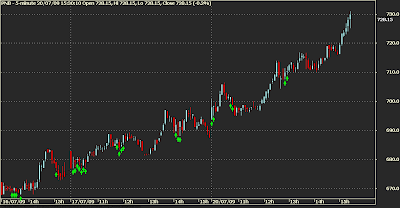

AND i found the falling wedge (a bullish pattern ) on daily charts, with all those signals,,it generated a buy call in nifty at 3966..on last monday.so a bottom was called with targets from 4267 --4305-4360,,levels which were clear resistance levels from different angles.these were fib. tgts,,the neckline resistance levels,and the falling trendline of the down channel/flag.

NOW WHAT ???..if the presented weekly chart of nifty was a 5/15 min. chart..i wouldve given a fast buy call for intraday, with just a 5 point below the low as a stoploss.BUT this being a weekly chart,i would prefer to wait just a little for some strong confirmation on daily charts.clearly its my TRADING SYSTEMS buy call.a chart is also presented with this article on how have i arrived at tgts of 5190---5600 for nifty.

for DOW their are two/three positives 1 ) quarterly bullish pattern ,completed 2 ) a probable inverted h&s on weekly charts 3 ) a top h&s reversal on daily charts..have failed...this factor only has got some fantastic bullish probabilties.

for ,our indices there s a weekly bullish flag which has got a very BULLISH TARGETS.

here , i am re-publishing a few sentences from my article ,last sunday.

""

AS on quarter basis, nifty has made quarterly MORNING STAR candle pattern,on the quarter ended june-2009...this implies that any fall in the coming quarter should be utilised as BUYING opportunity""

and

""

NOW on weekly charts..as shown in the 2 weekly charts..we are coming nearer tothe gapped area and weekly stochastic is for the first time entering the oversold area,after the steep rise started from early march 2009.in my opinion this should be a good buying opportunity."""

I also said that monthly picture will be disturbing if it goes down till hns tgts straight away...and the bearish momentum will be arrested with 200-300 rally in nifty,,it could have been only a corrective rally...but with such a strong close ,its already a new BULL MOVE started.

for gap filling..i dont know if gap filling has tobe taken as a rule.and pivotals like reliance has alreadey filled up the post election gap.

BESIDES ALL THESE ,i would like to have a little bit confirmation on daily charts for the propsed huge bull move and last hurdle is the falling trendline in both indices,,.charts being posted in next post.

any reader interested in my services can add bhoom2tika in ym

AS mentioned 2 days back,,4534 was very crucial level for me,,as one can see the chart,,its very clear that 4534 worked nicely as supports first and as resistance yesterday and even today,

AS mentioned 2 days back,,4534 was very crucial level for me,,as one can see the chart,,its very clear that 4534 worked nicely as supports first and as resistance yesterday and even today,